A MARKET OF NORMALIZATION AND OPPOSITES

Hello and welcome to this week’s edition of the No Straight Lines Investments blog, I appreciate you dropping in.

Let’s just put it out there, it has been an incredibly difficult market to navigate in 2025, as reflected in the performance of the S&P 500.

Even on it’s own, absorbing a policy-driven slowdown in U.S. growth - alongside AI disruption abroad, a rebalancing of global defense spending , and shifting trade flows - would be incredibly challenging.

Throw in extreme positioning and stretched valuation, it’s a lot for any investor to decipher.

With no high-conviction setup, I’ve mostly stayed put as I believe the U.S. administration does NOT intend to cause a recession.

So far that hasn’t been the correct move.

What do I mean by normalization?

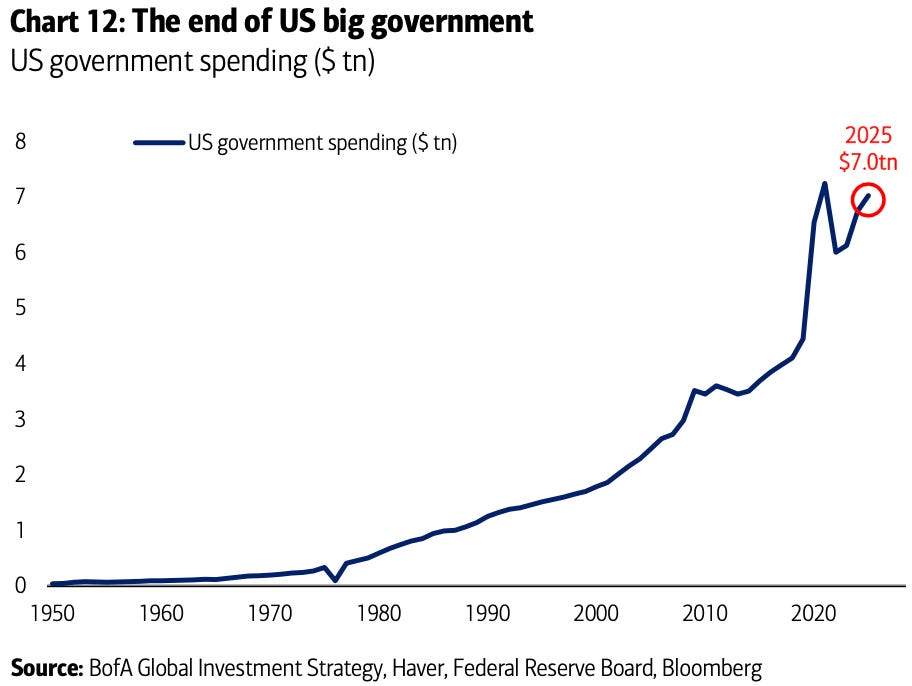

U.S. nominal GDP is up 50% over the past year whilst government spending is up 65% (thank you Mike Hartnett BofA). I acknowledge that the U.S. economy has performed admirably, but the fact that the budget deficit was >6% of GDP in 2024 isn’t always properly credited for supporting much of this growth.

Treasury secretary Bessent wants to reduce the deficit to 3% of GDP over the next few years.

The chart above is clearly not sustainable, we have seen major revisions to U.S. GDP growth over the past several weeks and equity markets have adjusted, albeit the presumption is that the transition to lower growth will not result in a recession.

If you would like to continue reading, please subscribe for $20/month using the button:

Here’s what you your paid subscription will get you:

Portfolio Stocks - this week I revisit an #athleisure name, #copper, #energy and #capitalmarkets ideas. It has been a tough tape but the ideas have managed an unweighted, average total return >40% since initial write up.

Flows - with the market moving at ever faster velocity, it is imperative to have a grasp of where the $$ are being allocated.

Charts of the Week - the week’s biggest movers along with any other charts I think are worth paying attention to. An efficient way to get the market pulse.

Macro that Matters - everything is taking a backseat to the flurry of pronouncements out of the White House, but I dig into the key weekly releases.

If this is it, thanks for reading and good luck with your investments!

You can follow me on X (@NSLInvestments), LinkedIn: Jonathan Lansky or using the chat feature on Substack.