WHAT A LONG, STRANGE (ROUND) TRIP IT'S BEEN....

Hello and thanks for reading this week’s No Straight Lines Investments blog, I appreciate you.

Given how brutal sentiment was right after Liberation Day on April 2, this week’s 2.9% surge in the SPX is a stark reminder of how quickly markets can rebound - remarkably, we’re right back where we stood just one month ago:

Table from Bespoke Investments

What’s the takeaway?

The “do nothing” strategy can be quite effective, particularly when the source of the damage (policy uncertainty) appears reversible.

The Trump administration has definitely struck a more conciliatory tone, which has propelled the recovery in markets.

Chart from Bespoke Investments

The hard truth is this: the success or failure of any strategy only becomes clear in hindsight - by the time it’s obvious, the opportunity is already gone.

Interesting tidbit from Bespoke Investments, the monthly return after the 11.2% drawdown (based on close) was the best turnaround since 1928!

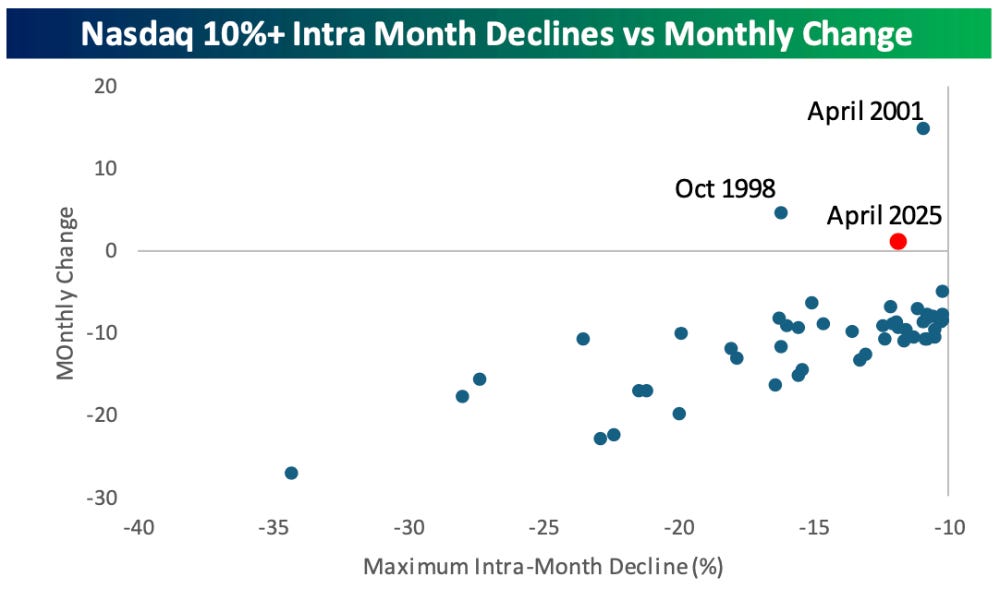

It’s a similar story with the NDX, although you can see that the drawdown/recovery isn’t quite as unique:

Chart from Bespoke Investments

Aside from the strong rally in equities, another signal of a sense of calm in the markets is the historic decline in the VIX:

In it’s relatively short history (created in 1990), this month’s rapid decline of the VIX from >40 to <24 has only been eclipsed on 2 other occasions (August 2015 and October 2020).

Chart from GS FICC

A similar climb down in SPX implied vol, with some history in the graph for perspective, these sorts of reversals do NOT happen often.

Elevated volatility is far from a death sentence for future returns - in many cases it sets the stage for outsized gains:

Chart from Bespoke Investments

If you would like to continue reading, please subscribe for $20/month:

If this is it for you, thanks for reading!

You can follow me on X (@NSLInvestments), LinkedIn: Jonathan Lansky, or using the Chat feature on the Substack app.

Best of luck this week with your investments.